Fight the Boom and Bust (Part 1): Income Tax

[one_third last=”no” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” border_position=”all” border_size=”0px” border_color=”” border_style=”” padding=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ class=”” id=””][fusion_text]May 9, 2017

Wyoming’s boom-and-bust economic cycle—and the state budget surpluses and crises that follow—has gone on so long it seems to some people here almost like a birthright. Or a birth defect.

It’s obvious that that state needs to diversify its economy in order to avoid the radical swings that result from fluctuating mineral prices, which result in massive layoffs, defunded public services, and a state of general precariousness for Wyoming’s working people.

In the midst of the present bust, the state faces a general revenue deficit in the hundreds of millions of dollars, including an estimated $400 million annual shortfall in public education funding.[/fusion_text][/one_third][two_third last=”yes” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” border_position=”all” border_size=”0px” border_color=”” border_style=”” padding=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ class=”” id=””][fusion_text]

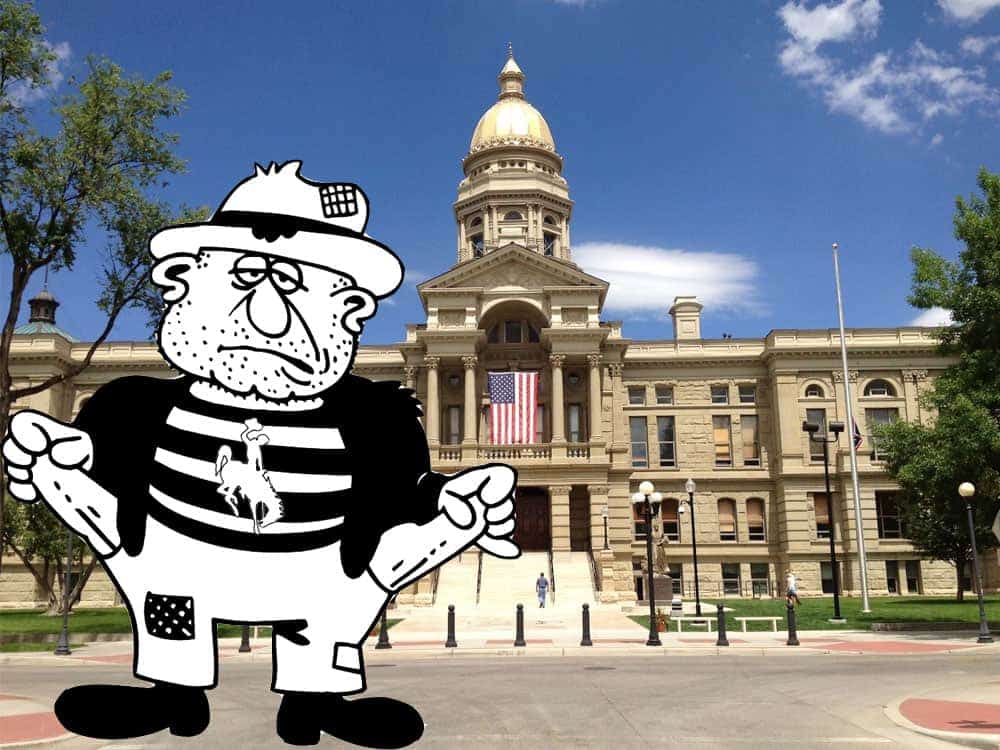

The state’s busted budget poses outside the Capitol in Cheyenne.

[/fusion_text][/two_third][two_third last=”no” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” border_position=”all” border_size=”0px” border_color=”” border_style=”” padding=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ class=”” id=””][fusion_text]Believe it or not, however, it wouldn’t take that huge of a tax hike to cover public education, and a little more would go a long ways toward stabilizing the state’s entire budget, even during down times for the mining sector. Legislators will posture like raising taxes is politically unthinkable—and, of course, taxes are unpopular in a state that’s used to mineral companies footing the bill for our public services. But establishing a modest corporate and personal income tax, along with increases in our low property taxes and/or sales taxes, and topping it all off with a hike of Wyoming’s “sin” taxes on cigarettes and beer would just about do it for education, with no further cuts beyond the $55 million schools have weathered in the past two years.

The Legislature has shown little to no interest in taking any of the above actions in recent years—especially establishing any state income taxes, personal or corporate. And even though lawmakers—particularly in the staunchly anti-tax Senate—might huff and puff, slash and cut, lie and deceive, and do whatever else they can to avoid new and raised taxes, the education shortfall is something they cannot ignore, lest they want to face a lawsuit.

If pressured by the public, perhaps legislators could be persuaded to seriously consider one or two of the tax proposals they’ve rejected before. Any new tax revenue they can muster would help ease the state’s plight. In addition to the $400 million in general education funding, the state has also seen its school capital construction funds disappear with the end of coal lease bonus money, so it has that education dilemma to solve as well.

A brief history of state income tax proposals

Even though they’ve always been the third rail for Wyoming politicians, let’s take a look at state individual and corporate income taxes first. One reason to start here is because nearly 20 years ago a brave band of a dozen people—all members of the Tax Reform 2000 Committee—said the Number One thing Wyoming could do to help balance its out-of-whack tax structure and improve its fiscal future was to start taxing incomes and lowering property taxes.

It wasn’t exactly a new idea, since some Wyoming legislators first proposed it during a special session in 1933. The income tax was defeated, but it came back in 1935, competing against bills that included an emergency sales tax, a lottery and “wide open gambling” throughout the state. A gambling tax sailed through the Legislature but was vetoed by the governor. An income tax bill, which opponents said was the work of the Communist Party, went down to defeat again, but lawmakers finally passed a supposedly “temporary” sales tax that is still with us today.

When it completed its report in June 1999, the Tax Reform 2000 Committee estimated an individual income tax would generate between $52 million and $150 million annually, depending on the tax rate and tax base used (it inconveniently failed to divulge what rate and base it used to make the estimate). The committee said there were no figures available that would enable it to calculate how much a corporate income tax might bring in.

The Tax Reform 2000 income tax recommendation was immediately ridiculed by state officials, including Gov. Jim Geringer, who declared it “dead on arrival.” Fortunately for Wyoming the minerals industry suddenly boomed again and the committee’s advice was relegated to the proverbial dusty shelf in some government office, rarely to be talked about again.

Is Wyoming anti-tax? Or are anti-tax Wyomingites just the loudest?

Still, state income taxes are highly thought of by many economists, including those who advise the Center on Budget and Policy Priorities. “State personal income taxes are subject to wider swings up and down, but over the long term grow more than other state taxes,” CBPP economist Elizabeth McNichol writes. “The relatively strong growth of the income tax revenue allows states to deliver public services at a level adequate to meet the needs of state residents and the challenges of an ever-evolving economy.”

A state income tax may not be the most popular idea in Wyoming, but some folks are willing to consider it. An October 2016 poll by the University of Wyoming Survey Analysis Center found that 49 percent of voters rejected the idea of a state income tax, but 18 percent approved it unconditionally, and 23 percent would accept an income tax if another state levy, such as sales or property taxes, was reduced at the same time.

Those numbers suggest that if a Wyoming politician (preferably a popular one) made a reasoned case for a state income tax, he wouldn’t be tarred and feathered. In fact, some voters might even show some respect for a legislator who doesn’t view a potentially significant revenue source like the moral equivalent of the walking dead.

Receive Better Wyoming communications in your email inbox by filling out the form on our homepage. You can also follow us on Facebook and Twitter.[/fusion_text][/two_third][one_third last=”yes” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” border_position=”all” border_size=”0px” border_color=”” border_style=”solid” padding=”” margin_top=”” margin_bottom=”” animation_type=”0″ animation_direction=”down” animation_speed=”0.1″ class=”tomoveSidebar” id=””][tagline_box backgroundcolor=”” shadow=”no” shadowopacity=”0.7″ border=”1px” bordercolor=”” highlightposition=”top” content_alignment=”left” link=”” linktarget=”_self” modal=”” button_size=”” button_shape=”” button_type=”” buttoncolor=”” button=”” title=”TELL THE JOINT REVENUE COMMITTEE TO FIX WYOMING’S BROKEN TAX STRUCTURE” description=”” margin_top=”” margin_bottom=”” animation_type=”0″ animation_direction=”down” animation_speed=”0.1″ class=”” id=””]

Wyoming’s current budget crisis is a perfect example of the harm our current tax structure inflicts. Facing a deficit of hundreds of millions of dollars, the state is axing major public services like education, healthcare, corrections, and infrastructure maintenance, while defunding programs from suicide prevention to Meals on Wheels.

The Joint Revenue Committee will meet this Thursday and Friday, May 11 – 12, to potentially make much-needed reforms. Use this quick and easy form to encourage them to save us from the boom-and-bust revenue roller coaster that defunds our public services.

[/tagline_box][/one_third]

Comments are closed.