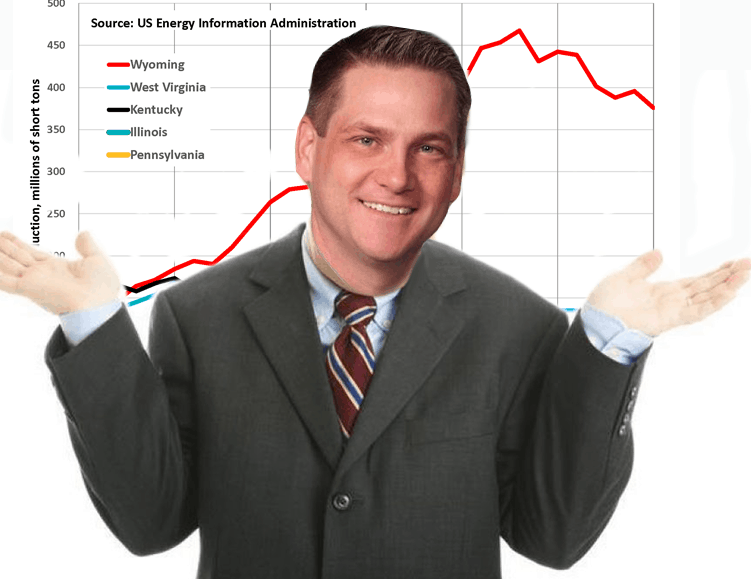

Wyoming faces the biggest financial crisis in its modern history. Lawmakers respond by doing nothing.

Plummeting oil prices during the COVID-19 crisis have piled atop preexisting struggles in the coal and natural gas industries to present Wyoming with a projected $1.5 billion budget shortfall.

The state depends on tax revenue from these three fossil fuel mining sectors for well over half of its budget. Now that all three industries are tanking, the need for alternative forms of tax revenue in Wyoming is clearer than ever.

So, one might have expected the Legislature’s Joint Revenue Committee to spring into action—or, at least something resembling action—at its meeting last week in order to address the worst fiscal catastrophe in Wyoming’s modern history.

Instead, the committee buried its collective head in the sand and did essentially nothing. It took no action, moved no proposals forward, and in general failed at its single task: to ensure that Wyoming has appropriate means of funding the public services and infrastructure we all depend on.

No solutions for the special session

The legislature is set to hold a special five-day session starting June 29 to address problems related to the COVID-19 pandemic. Since the state’s dramatic budget shortfall is related to the coronavirus, proposals to generate revenue or otherwise gin up resources for the state would have been fair game.

Like a deer in the $1.5 billion-deficit headlights, the committee froze.

But as a result of the Revenue Committee’s inaction, no bills to help solve the state’s financial problems are likely to be heard by the full legislature any time soon.

And it’s not as though the committee was without options. Its agenda was packed with potential ways to raise revenues and bring in resources, many of which the committee had previously fine-tuned and even sponsored.

But like a deer in the $1.5 billion-deficit headlights, the committee froze. Now the state gets to feel the impact.

Medicaid expansion: risky, or unoriginal?

One measure on the Revenue Committee’s agenda was expanding Medicaid. This non-tax proposal would bring in tens of millions of dollars per year to Wyoming to strengthen our healthcare system and cover tens of thousands of uninsured state residents.

Sen. Bo Biteman

Job losses resulting from the COVID-19 pandemic have left countless Wyomingites without insurance coverage. In response, the Legislature’s Management Council directed the Revenue Committee to consider a Medicaid expansion proposal. The Revenue Committee supported such a proposal last year, although it was defeated in the House during the legislature’s 2020 budget session.

This time around, committee members balked and chose not to even vote on the Management Council’s directive. Instead, they will continue to “study” the issue.

Sen. Bo Biteman (R-Ranchester), a staunch supporter of doing nothing, complained that Medicaid expansion was a “tired idea” that would “grow government.” It’s “a horse we’ve beaten to death many times,” he said.

Ironically, when expanding Medicaid first became a possibility years ago, Wyoming lawmakers hemmed and hawed about all its uncertainties: Would the federal government pay its share? Would it increase the national deficit? Would it actually drive down state healthcare spending?

But now that 37 states have the program up and running, the doomsday predictions have failed to come true, and questions about the program’s success have been answered, lawmakers like Biteman now criticize it for being unoriginal.

No lobbyists for poor folks

Do-nothing lawmakers like Biteman had plenty of encouragement from the typical cast of “don’t tax my team!” lobbyists.

Kara Choquette of the Chokecherry and Sierra Madre wind farm being built in Carbon County said a proposed increase to wind energy tax would be “devastating” to the project and others in Wyoming. She warned it would drive away other wind developers, despite Wyoming having some of the best wind resources in the nation.

Chris Brown of the Wyoming Retail Association and the Wyoming Lodging and Restaurant Association said both groups oppose a proposed corporate income tax. He said some dine-in restaurant corporations are down 40 percent in revenue compared to last year.

One proposal that the committee did agree to entertain was removing the state’s sales tax exemption on groceries. This is partly because there were no lobbyists present representing poor people in Wyoming, whom the proposal would impact the most.

Sales taxes, in general, are regressive. Low-income people pay a much larger portion of their income on taxable purchases than wealthier people do. When it’s an essential item like food that is taxed, the state is literally trying to balance its budget on the backs of the poor.

But, desperate for his committee to do anything, co-chairman Sen. Cale Case (R-Lander) agreed that the proposal would be “fair game” for further consideration.

No action until we feel the pain

In what one might consider a shabby silver lining, the committee did agree to invite members of the Tax Reform 2000 commission to its next meeting.

The Tax Reform 2000 commission’s primary recommendation was that Wyoming adopt an income tax.

That commission was convened during Wyoming’s last bust, in the late 1990s, to begin the process of transitioning our tax system away from dependence on fossil fuel mining.

But then we entered another boom thanks to the invention of fracking. The state’s coffers grew full of severance tax revenue, and the desire for tax reform was forgotten.

Now that Wyoming appears screwed again—and this time for real—the Revenue Committee will revisit that commission’s report, though they already know what they’ll find.

Its primary recommendation was that Wyoming adopt an income tax.

Wyoming lawmakers know well that this is one of the only real, feasible solutions to the state’s problems. But it’s doubtful they’ll act until the state experiences something that no living Wyomingite has—the actual repercussions of dramatic cuts to our public services and infrastructure.