When Wyoming legislators began issuing property tax breaks this election year in response to voters’ anger over skyrocketing home valuations and tax bills, they chose to give extra special relief to Baby Boomers—the wealthiest generation in history.

Among a handful of other more well-reasoned and targeted tax breaks that passed during the 2024 session, the Legislature approved a bill specifically to lower taxes for long-term resident homeowners older than 65.

The rationale, according to lawmakers, is that Wyoming is chock full of seniors on fixed incomes who can’t afford higher taxes. But as legislators provided relief to those folks, they also ended up giving tax breaks to ultra-rich residents in Teton County and elsewhere in the state who hardly need a handout.

It just so happens that nearly half of the Wyoming Legislature is old enough to qualify right now for a tax break, or will be in the next couple of years. So, they gave a tax break to themselves.

Nearly half of the Wyoming Legislature is old enough to qualify right now for the new tax break

Some got a good laugh out of recusing themselves from voting on the bill because they would benefit from it.

This might be the natural outcome of Wyoming’s rapidly aging population, or the fact that few of the state’s young people vote.

But prioritizing seniors at the expense of everyone else is certainly not surprising from a body that passes laws that drive young professionals out of the state, refuses to support programs that help working families, and that has generally failed to diversify the state’s economy or stop its brain drain.

Oldster influence

Since Wyoming has a “citizen” legislature, many of its members are older, retired folks with plenty of free time and enough money to pay for expensive campaigns.

Of the Legislature’s 93 members, roughly 45 percent either already meet the age threshold for the tax break or will soon.

But the oldsters’ influence is even greater. The Senate—the Legislature’s “Upper Chamber”—skews older than the House by nearly 20 percent, and Legislative leadership is far older on average than the rest of the body.

To be clear, not every older Wyoming legislator will reap a material benefit from House Bill 3 – Property tax exemption for long-term homeowners. To qualify for the 50 percent exemption, a resident must not only be more than 65 years of age, but they also must have owned their home for 25 years.

Since many members of the legislature—and particularly the so-called Freedom Caucus—are new to the state, some are merely helping their fellow Boomers.

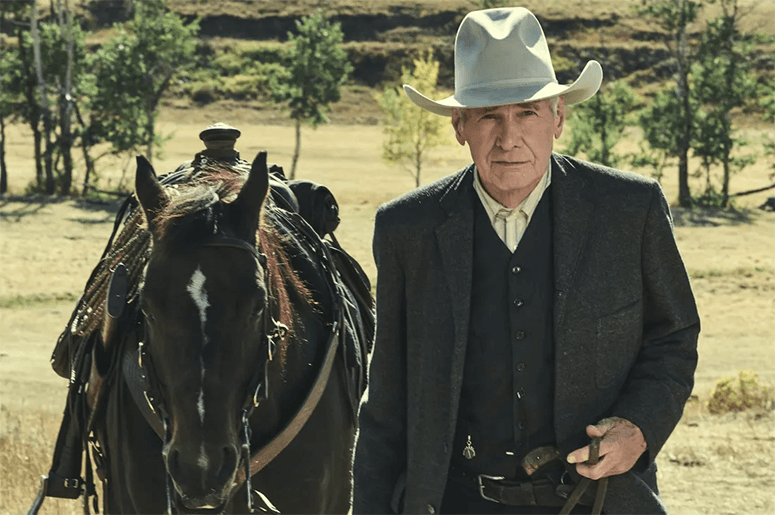

Tax break for Indiana Jones

There certainly are elderly longtime Wyoming residents on fixed incomes who cannot afford large increases to their tax bills, and relief for them is appropriate.

But 81-year-old megastar actor Harrison Ford has owned his home in Jackson since the 1980s, and he would probably be fine without the help.

Thanks to the Legislature, he’s getting a tax cut anyway.

Of course, when crafting tax policy, it’s easy for the Legislature to give tax relief to those who actually need it, but not to those who don’t.

In fact, Rep. David Northrup (R-Powell) sponsored an amendment to HB-3 that would have done just that. He proposed a change to the bill that would have made the tax break available only to residents whose household incomes are less than 300 percent of the state median, or roughly $215,000 a year—hardly the level of paupers.

But the House voted it down, ensuring that Harrison Ford and his wealthy friends get even more tax help.

Refunds for those who actually need them

Fortunately, other measures to confront rising property taxes that passed this session were more thought-out.

Wyoming has among the lowest property tax rates in the nation. But wildly increasing home values have driven overall property taxes up more than 80 percent in the past six years, making the issue a priority for pretty much all state lawmakers.

“I believe that exceeds the original intent of the program, which was to provide a hand up, not a handout.”

House Bill 4 – Property tax refund program expanded a program that provides targeted refunds to people who struggle to pay their tax bills (people on fixed incomes, for instance).

“It was wildly popular and so well used that we put $20 million into it,” Rep. Dan Zwonitzer (R-Cheyenne) explained at a recent event.

In 2023, more than 8,800 homeowners received a property tax refund if they made up to 125 percent of their county’s median household income. HB-4 expands that program for 2025 to include homeowners who make up to 145 percent.

The bill the Legislature passed had an even more generous threshold—165 percent—but Gov. Mark Gordon used his line-item veto power to eliminate the top income tier.

“I believe that exceeds the original intent of the program, which was to provide a hand up, not a handout,” the governor wrote in his veto message.

No more rapid increases

Another reasonable measure that passed this year is a cap on-year-to-year tax increases.

House Bill 45 – property tax exemption-residential structures and land will exempt all property tax increases over 4 percent per year. Effective immediately, qualified homeowners will be able to apply the exemption to the 2024 tax year.

“By passing this bill, we curb out-of-control property tax increases that affected the residents of Wyoming the past few years,” said HB-45’s sponsor, Rep. Barry Crago (R-Buffalo). “Homeowners have the certainty of knowing their property taxes will not increase by more than 4 percent.”

Even proponents of relief cautioned that this bill could have a negative effect over time and should be closely watched.

If assessments go up more than 4% each year, Zwonitzer said, “Five or 10 years down the road, there could be very significant concerns to your local schools, etc.”

“I think it’s a great thing for the near-term future while we stabilize, but it’s just a long-term unknown,” he added.

Gordon vetoes “socialistic” tax relief

The property tax relief bill that had the most support from lawmakers—it passed 29-2 in the Senate and 61-1 in the House—was vetoed by Gov. Gordon after the session adjourned.

Senate File 54-Homeowner tax exemption would have applied a 25 percent exemption to the first $2 million of a home’s fair market value, giving an across-the-board tax cut for all Wyomingites, rich and poor.

But in his veto message, Gordon said the bill’s $220 million reimbursement to local governments for lost revenue was insufficient and no relief to the taxpayers who paid them, but instead would go to property owners generally.

He called it a “socialistic-type of wealth transfer, mostly from the energy sector, to Wyoming homeowners.”

SF-54 was among the talking points members of the so-called Freedom Caucus trumped up in their calls for a special session to override Gordon’s vetoes, but they were unsuccessful in their attempt.