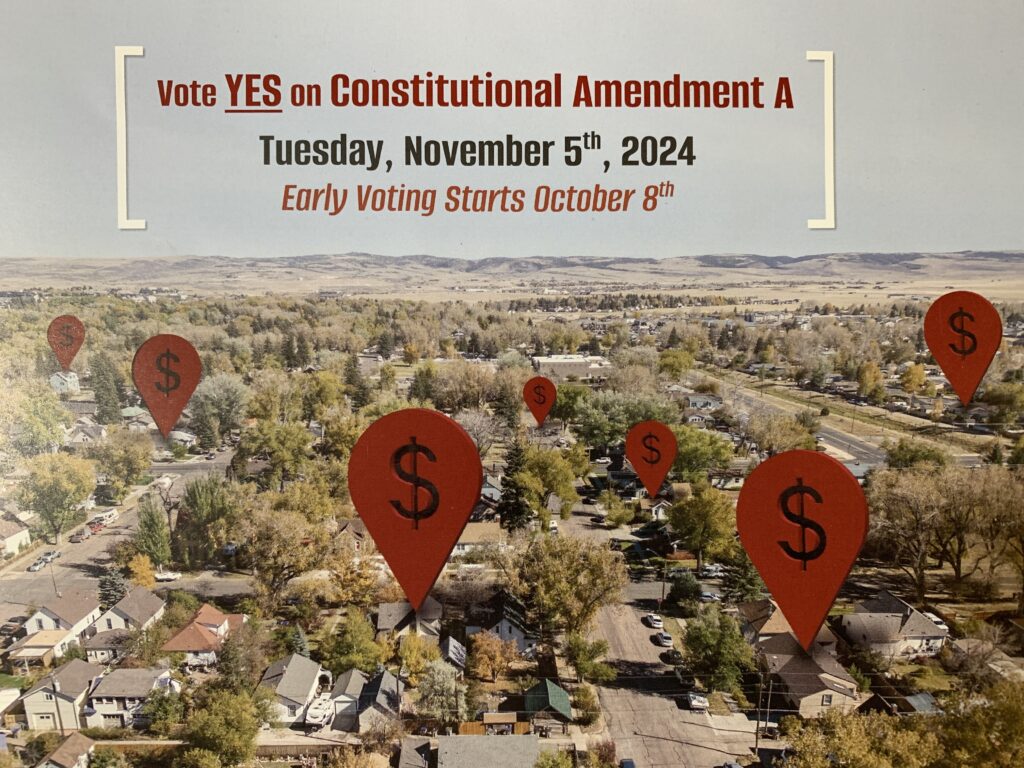

Wyoming residents who want to see lower property taxes can vote for a constitutional amendment in 2024 that could pave the way for that outcome.

Property taxes have increased in many parts of Wyoming in recent years, fueled in large part by an influx of wealthy new residents.

Lawmakers attempted to find solutions during the last two legislative sessions. But they have been stymied by the way in which Wyoming tax law lumps together residential property with commercial and industrial properties.

The amendment would not raise or lower any taxes in and of itself. But it would improve lawmakers’ ability to make adjustments.

Taxpayers in all three classes currently pay the same rate, 9.5%, which is among the lowest in the nation.

“Amendment A”—as it will appear on voters’ ballots—would separate owner-occupied residential property tax rates from the rest. This is common practice across the nation, where huge commercial properties, industrial sites, and second homes are taxed at different rates than people’s primary residences.

Gov. Mark Gordon supports Amendment A because it allows for new approaches to property tax policy. “I think it’s worth doing because it gives us a tool to talk about property tax a little bit differently,” he said.

The amendment would not raise or lower any taxes in and of itself. But it would improve lawmakers’ ability to make adjustments when balancing the need for tax fairness against the need to use property tax revenue to fund critical public services.

Like this article? Sign up to receive updates on Wyoming issues that matter to you.

Relief for everyday people, not Walmart or Facebook

While property values—and, in turn, property taxes—have risen across Wyoming in recent years, the effect is much more dramatic in fancier, picturesque communities that attract millionaires and billionaires.

The epicenter of this, of course, is Teton County, where the average home price is now $7 million. This includes many “second homes” of the richest people in the world.

Teton County legislators support Amendment A because they see the problem up close: both the struggles of homeowners on fixed incomes facing higher tax bills, and also the way in which ultra rich people can scoop up luxury properties nearly tax free.

Rep. Mike Yin (D-Jackson) said Amendment A can help everyday residents in the state who need their taxes lowered, because the legislature would be able to adjust owner-occupied property tax rates without giving tax breaks to either ultra-wealthy second homeowners or big businesses like Walmart or Facebook.

His colleague, Rep. Liz Storer (D-Jackson), helped push through the bill in the legislature that put “Amendment A” on the ballot. She notes that in nearly every other state, commercial property tax rates are far higher than residential rates, making Wyoming’s commercial property tax rate far below the national market.

Realtor support

Laurie Urbigkit, the Wyoming Realtor Association’s government affairs director, said one of the reasons her group urges a “yes” vote on Amendment A is because it will allow lawmakers to lower taxes on the homes of people who need it.

“During the pandemic, we saw a huge influx of buyers from out of state coming to Wyoming,” Urbigkit wrote in the group’s September newsletter. “We’re not complaining, we get it. But it raised our property values and therefore our property taxes dramatically.”

The WRA is running a series of TV commercials supporting the amendment. Urbigkit said polling by her group found that while only 40 percent of voters initially supported the amendment, it increased to 84 percent when they were informed about what it does.

Some critics of cutting property taxes rightly worry about the loss of revenue for public services like schools, roads, and water infrastructure.

Urbigkit argues that Amendment A is just a first step in the property tax relief conversation, and lawmakers would be left to decide how to make up any lost revenue.

“They have the ability to do the backfill if they see fit, and they have the ability to be more careful with their tax cuts,” Urbigkit told the Sheridan Press. “We’re not asking for a huge slash. We’re just saying [real estate] should be its own class so that the Legislature can deal with it appropriately.”

Remember to Mark Your Ballot

It’s important for people who support Amendment A’s passage to remember to complete portion of their ballot.

According to how ballot questions work in Wyoming law, Amendment A must not only receive more “yes” votes than “no” votes—it must receive a majority of “yes” votes out of the total number of votes cast.

If someone leaves the question about Amendment A blank, it counts as an automatic “no” vote.

Amendment A is a value-neutral tool. Ultimately, if Wyoming lawmakers want to raise or lower property taxes, they will.

A “yes” vote on Amendment A is simply a vote to give legislators the ability to adjust property taxes with fewer harmful unintended consequences.