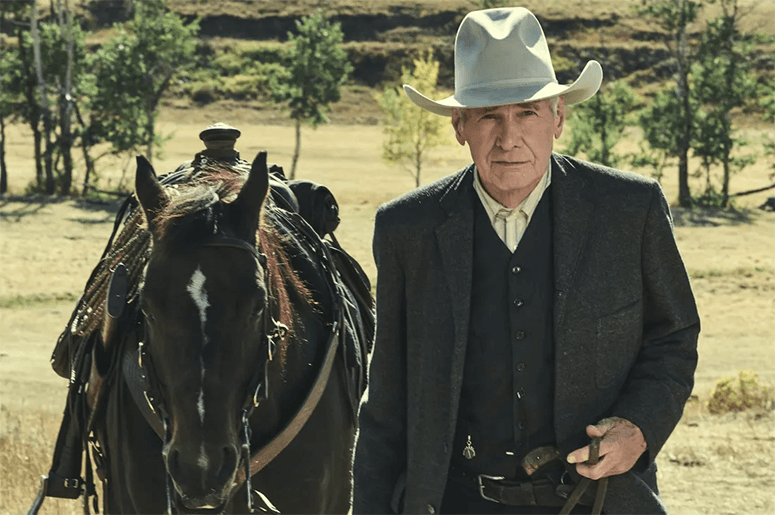

Session recap: Harrison Ford and other needy Wyoming seniors receive property tax relief

Wyoming legislators wanted to give property tax relief to seniors on fixed incomes, but gray-haired lawmakers couldn’t help giving a bit of relief to themselves—despite the Baby Boomer generation being the richest in history.

Fortunately, other successful property tax proposals this session were more thought-out.

Session recap: Harrison Ford and other needy Wyoming seniors receive property tax relief Read More »