BUDGET RECAP (Part 3): Lawmakers do pass taxes (as long as they’re not taxes)

Part 1: Healthy Babies Cost Too Much

Part 2: Smoke ‘Em if You Got ‘Em

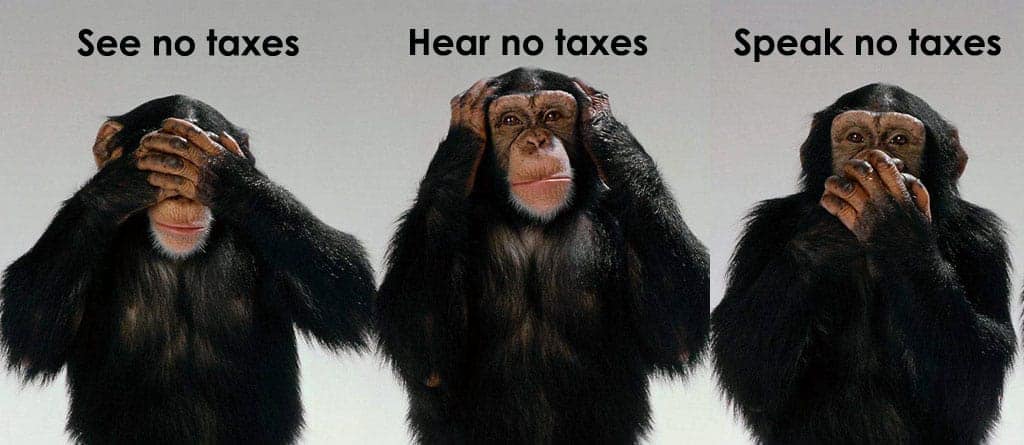

It’s not that Wyoming lawmakers don’t understand that the state needs new revenues—despite evidence to the contrary, they’re not exactly dense.

The problem is that they lack the political will to do what’s necessary to ensure the people of Wyoming have the baseline public services to operate as a modern, first world society. Having been bludgeoned by anti-tax propaganda from right-wing think tanks (which are funded by billionaires who don’t need public services), these lawmakers seem to imagine their constituencies are made up entirely of foamy-mouthed free-market radicals who would rather privatize water than pay a sixpenny for infrastructure.

But they’ve found a safe workaround that at least lets them sleep at night: Raising new revenues through “fees” instead of taxes, and passing new taxes that aren’t technically “new.” These, of course, raise paltry sums and are nowhere near sufficient to meet the dramatic budget shortfall caused by declines in mining revenues.

No more honor system for online sales tax

The Joint Revenue Interim Committee sponsored House Bill 19, which allows the state to collect sales tax for online purchases made in Wyoming. These taxes were supposed to have been paid voluntarily all along—but unsurprisingly, no one paid them.

HB-19 applies to purchases made from businesses outside Wyoming that make at least $100,000 in gross revenue from sales to the state, and that have an annual total of at least 200 transactions with customers in the state. Even before the bill was introduced, Gov. Matt Mead announced that Amazon.com had agreed to start collecting sales tax from Wyoming buyers on March 1.

The committee estimates that Wyoming could receive nearly $30 million annually from the new collection method. Legislators were particularly happy they could pretend it’s not a new tax, so technically they are not breaking their “no new taxes” pledge they signed for the Wyoming Liberty Group.

HB-19 easily passed both chambers, which illustrates that the lawmakers aren’t necessarily against new taxes—they just don’t want to be blamed for them.

The bill had the support of retail trade associations, small businesses, and Gov. Matt Mead, who called it “an important step in the right direction.” The governor said online retailers had an unfair advantage over brick-and-mortar stores.

Fees aren’t taxes, right?

Meanwhile, a scant bit of new revenue will result for several raised fees in the state. The Joint Appropriations Committee sponsored two fee-raising bills: HB-218, which doubles the cost of vehicle registration; and HB-219, which raises the cost of a drivers’ license from $20 to $40. They both passed by wide margins.

The House Appropriations Committee successfully sponsored HB-288 to help the Wyoming Game & Fish Department make up a portion of the $9.8 million cut from its budget by the Legislature. The department raises the vast majority of its own budget from hunting and fishing fees, and sportsmen’s groups have regularly supported fee increases because they consider the agency’s role in protecting wildlife vital.

The bill, which is estimated to bring in an additional $5 million annually to the department, raises numerous license fees for residents and non-residents that will go into effect Jan. 1, 2018. For a complete list of the new G&F fees, click here.

I think I can, I think I can … I can’t: The tax bills that’s couldn’t

And then there’s the litany of tax bills that, unlike the Little Engine That Could, didn’t make it over the mountain to bring toys and good food to the children of the mountain town. Here’s an uncomprehensive rundown:

The answer is not blowing in the wind:

Two wind tax bills were defeated. HB-127, sponsored by Clem, attempted to quintuple the tax from 1 percent to 5 percent per megawatt hour generated. It was not a shock when the House Revenue Committee rejected the gigantic tax increase.

HB-285, sponsored by Rep. Don Burkhart (R-Rawlins), wanted to provide an incentive to wind farms to manufacture wind turbines in Wyoming. Currently all wind turbines used in Wyoming are shipped in from other states, which is a lost opportunity for manufacturing jobs that could accompany the local proliferation of wind farms. HB-285 would have cut the wind generation tax by 50 percent for 10 years for companies who built their turbines here. The Revenue Committee didn’t take a vote on the proposal.

No vacancy:

A pair of lodging tax bills failed. HB-102, sponsored by Rep. Bill Henderson (R-Cheyenne) would have allowed towns, cities and counties to raise the maximum lodging tax that could be charged from 4 percent to 6 percent. Rep. Dan Laursen (R-Powell) sponsored HB-290, which would have created a state lodging tax of 1 percent. The House Revenue Committee did not vote on either bill.

Industrial-strength confusion:

Two bills that would have changed the property tax rate for industrial property—one up and one down—both failed. Madden’s HB-162 would have raised the rate from 11.5 percent of fair market value to 13.5 percent. It passed committee but was never considered by the full House.

HB-134, sponsored by Rep. Bill Hallinan (R-Gillette), went in the opposite direction. As an incentive to bring industries to Wyoming, the bill would have charged new industrial companies only a 5.5 percent property tax for the first three years and 9.5 percent during the fourth year. After that, they would pay the state’s established rate of 11.5 percent of fair market value.

Hallinan’s bill didn’t make it out of the House Revenue Committee, which signaled that perhaps now is not the time for big-business tax breaks by voting against it 1 – 8. Hallinan cast the lone vote in its favor.

Fossil fuel fools:

Hallinan wasn’t through offering ideas to help lower the tax bills of some industries. HB-104 would have reduced the severance tax on coal from 7 percent to 6 percent. Once again, Hallinan was the only member of the nine-member committee to favor the bill.

HB-172, sponsored by Rep. David Miller (R-Riverton), would have exempted new producers of crude oil and natural gas from paying severance taxes for the first four years. But once again, the Legislature wasn’t so crazy as to dole out tax exemptions in that magnitude in the midst of a budget crisis.

A stiff cocktail of failures:

The Legislature considered three bills that would raise the state’s alcohol taxes and killed them all. Wyoming hasn’t increased its alcohol taxes since Prohibition—a point of pride some lawmakers like to chortle about as they defund public schools.

HB-166, sponsored by Rep. Cathy Connolly (D-Laramie), would have raised the tax on wine from three-quarters of a cent to 1.9 cents; spirits from 2.5 cents to 9.9 cents; and the malt beverage tax on one liter from a half-cent to 5.3 cents. It would have allocated most of the funds to schools. The bill narrowly passed committee before the full House destroyed it with an 8 – 51 vote.

Clem brought the other two alcohol tax bills. HB-155 would have raised the wine tax to 5.4 cents, spirits to 17.5 cents, and malt beverages to 3.5 cents. The House Revenue Committee showed its disapproval with a unanimous vote against the bill, 0 – 9. Then they all went out for highballs!

Clem also sponsored HB-274, which proposed more modest tax rates: 2.25 cents for wine, 7.5 cents for spirits and 1.5 cents for malt beverages. The House Revenue Committee didn’t even take a vote on this one.

Screw the elderly and disabled:

If the Legislature had a compassionate change of heart since the 2016 budget session, when it totally eliminated the Tax Rebate for the Elderly and Disabled program, it had the perfect vehicle to bring the program back.

HB-100, sponsored by Hallinan, would have restored $4.1 million to fund the popular program. Unfortunately, there isn’t a huge contingent of professional lobbyists promoting the needs of seniors and the disabled.

These overlooked constituents obviously don’t have the resources to flood legislators with calls and emails, and they certainly can’t afford to wine and dine their representatives (even with our low, low alcohol tax rates!).

Both eligible seniors and the disabled had come to count on the tax rebate for end-of-the-year (or end-of-life) expenses. But the House Revenue Committee couldn’t muster a single vote for HB-100, which died 0 – 7.

Receive Better Wyoming communications in your email inbox by filling out the form on our homepage. You can also follow us on Facebook and Twitter.

Comments are closed.