What will Wyo lawmakers do with an extra $3 billion this year?

A year ago, with fossil fuel tax revenues down and Wyoming’s economy sputtering, Governor Mark Gordon and the Legislature gutted the state budget.

They cut public services across the board, from higher education to the highway department, reducing state spending by $430 million and eliminating 324 state jobs.

The Department of Health fared worst, with more than $100 million cut from its budget alone. Ninety percent of that agency’s funding “passes through” to local hospitals and clinics, which means funding cuts at the capitol result in fewer healthcare jobs and poorer health services in communities statewide.

In addition, the Legislature refused to include in a cost-of-living raise for Wyoming teachers, despite historically high inflation. This move prompted a lawsuit against the Legislature from the statewide teacher’s union and many Wyoming school districts.

But, now, the boom-and-bust cycle of our mineral-dependent economy has swung back in the other direction. As the Legislature prepares for its 2023 general session, the state of Wyoming is looking at a nearly $1 billion budget surplus thanks to record-breaking oil-and-gas industry profits and rebounding coal production.

At the same time, the state’s “Rainy Day Fund” has reached its highest level ever, containing more than $2 billion, thanks in part to unspent federal COVID-19 emergency funds. This is in addition to Wyoming’s other various trust funds and “coffee cans,” which total in the ballpark of $23 billion.

In other words, Wyoming is sitting on a boatload of money. At times like these, lawmakers have the opportunity to make strategic investments in infrastructure and communities, create jobs, and diversify our economy beyond the boom-and-bust mineral industries. That’s the kind of thing smart business people do, right?

Lawmakers have the opportunity to make strategic investments in infrastructure and communities, create jobs, and diversify our economy.

This, sadly, is the opposite of what Gov. Gordon and lawmakers appear poised to do.

Instead of investing in our state programs and agencies that need money now, or supporting areas of new growth and economic diversification, Governor Gordon’s newly proposed budget plans to sock this windfall away.

Gordon appears to prefer investing in Wall Street rather than Wyoming’s Main Streets, despite the poor return on investment we receive. Like a miser who imagines that the State of Wyoming will retire some day, he appears to be attempting to build Wyoming a fat 401k.

Budget decisions like these are precisely what keeps Wyoming locked in the boom-and-bust status quo, yoked to the mineral industries instead of developing new ones, incapable of retaining its young people, and unable to change.

Fossil fuels, federal funds spur surplus

Wyoming depends on taxes from the fossil fuel industries—oil, gas, and coal—for the majority of its budget. These industries pay the taxes that support our schools and other public programs, agencies, and institutions.

Our mining-based tax system is what allows Wyoming residents to pay among the lowest individual tax rates in the United States. According to the Tax Foundation, Wyoming residents have the second lowest tax burden in the nation, behind Alaska, another oil-centric state.

While average Wyoming residents and businesses felt financial pain from high gasoline prices this summer and high natural gas prices this winter, oil and gas companies were reaping the rewards. These high prices drove record profits, and in turn created record state tax revenue.

Coal production also rose last year, giving the industry that has been on a steady downslide a temporary boost—and, along with it, a bump in coal-generated tax revenue.

High gas prices drove record profits, and in turn created record state tax revenue.

This is how Wyoming went from an $850 million shortfall yesterday to a nearly $1 billion surplus today.

Meanwhile, federal COVID-19 relief funds from the American Rescue Plan Act and the Bipartisan Infrastructure Law have helped pad the state’s “Rainy Day Fund” to its highest level in history, more than $2 billion.

Poor return on investment

This week, the Legislature’s Joint Appropriations Committee convened in Cheyenne in advance of the 2023 legislative session, which begins Jan. 10.

Committee members are meeting to discuss the annual budget proposed by Gov. Gordon, which the full legislature will then consider during the session.

Gov. Gordon’s proposed budget includes an $18.7 million bump to the Department of Health’s budget (which was cut by $100 million last year), $50 million to cover inflation for state construction projects, and $70 million more for public education, among other relative increases.

But he also proposed to sock away nearly half a billion dollars into the state’s Permanent Mineral Trust Fund instead of investing it in communities or local economies.

Once money enters the state’s Permanent Mineral Trust Fund, it is essentially untouchable. The purpose of the fund, which now contains about $10 billion, is to generate investment returns.

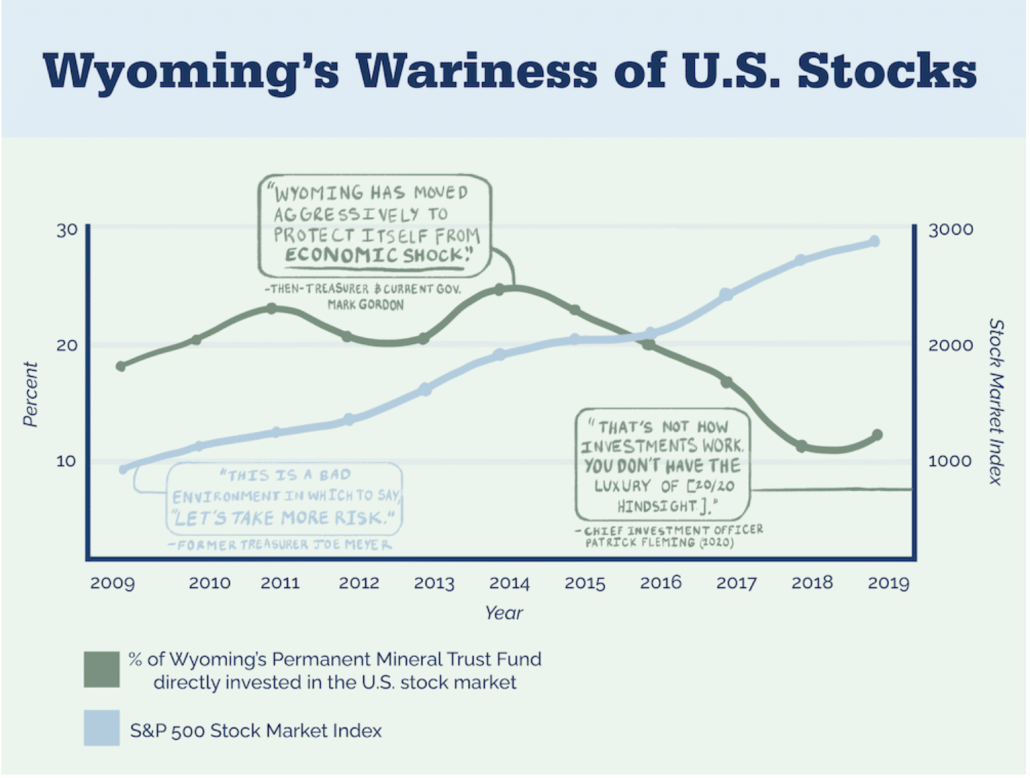

But the fund has not generated anywhere near market-rate returns for years, meaning that Wyoming puts money into it, but little comes back out.

The Permanent Mineral Trust Fund is not an outlier in the state’s investment portfolio. In fact, all of Wyoming’s investment earnings have been sub-par over the past several decades.

This seems to indicate that there are probably better things to be doing with our windfall tax revenues than stuffing them away into low-earning trusts.

Invest in Main Street, not Wall Street

So, what should Wyoming do instead? Invest in Main Street, not Wall Street.

Wyoming cities and counties have been struggling mightily for several years. As recently as 2020, Gov. Gordon worried about having to “abandon small towns” because the state would be unable to help pay for their infrastructure.

Today’s budget surplus could help alleviate those struggles and provide funding for projects like Rawlins’ crumbling water system. It’s hard to imagine places like Rawlins being able to attract or grow new business without water.

It’s hard to imagine places like Rawlins being able to attract or grow new business without water.

Of course, steady revenue is only part of the equation when it comes to economic development, but it’s a critical component. Diversifying our economy will require at a bare minimum things like an educated workforce and access to quality healthcare.

Wyoming could invest, for instance, in early childhood education, which is proven to be a cost-effective way of improving statewide student performance. We’re one of six states that refuses to provide any state funding for preschool.

Wyoming’s decades-long struggle to diversify its economy is the product of many and complex factors. But one thing is clear: If we continue to do the same thing, we will get the same results.

The strategy of stuffing any and all extra money we have on hand into savings because we’re fearful of the next bust has not moved us forward one inch.

Unless lawmakers gain the courage to take a different approach, not even $3 billion will get us unstuck.